The most effective way to save money on Acura ZDX insurance is to begin comparing prices regularly from different companies who can sell car insurance in Scottsdale. Rates can be compared by completing these steps.

The most effective way to save money on Acura ZDX insurance is to begin comparing prices regularly from different companies who can sell car insurance in Scottsdale. Rates can be compared by completing these steps.

- First, read and learn about how insurance companies determine prices and the measures you can control to drop your rates. Many factors that drive up the price such as at-fault accidents, careless driving, and a not-so-good credit history can be amended by making lifestyle changes or driving safer.

- Second, obtain price quotes from independent agents, exclusive agents, and direct companies. Exclusive agents and direct companies can give quotes from a single company like GEICO and Allstate, while independent agencies can quote prices from multiple companies.

- Third, compare the quotes to the premium of your current policy to see if switching to a new carrier will save money. If you find better rates, make sure coverage is continuous and does not lapse.

- Fourth, provide proper notification to your current company to cancel your existing policy. Submit a completed application and payment to your new insurance company. As soon as you receive it, keep the new proof of insurance certificate along with the vehicle’s registration papers.

The key thing to remember is that you’ll want to compare the same deductibles and limits on every price quote and and to get rate quotes from as many auto insurance providers as possible. This ensures a fair price comparison and many rates to choose from.

It’s a known fact that insurance companies want to keep your business as long as possible. Insureds who shop around once a year are likely to buy a different policy because they have good chances of finding coverage at a cheaper rate. A recent insurance study discovered that consumers who compared rates once a year saved $865 annually compared to those who never compared rates.

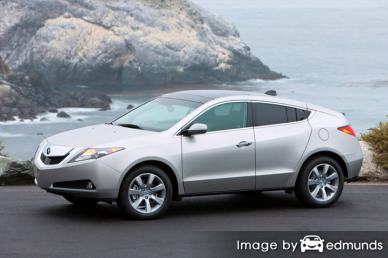

If finding discount rates on insurance in Scottsdale is why you’re reading this, learning how to get price quotes and compare cheaper coverage can help simplify the task of finding more affordable coverage.

If you have a current auto insurance policy or need a new policy, you can learn to find the best rates without reducing coverage. Locating the best rates in Scottsdale is quite easy. Smart shoppers just have to use the most efficient way to compare rates online.

Insurance Premium Influencing Factors

Lots of things are taken into consideration when pricing auto insurance. Some are obvious such as your driving record, but some are not quite as obvious such as your credit history and annual miles driven.

The following are some of the factors utilized by car insurance companies to help set your premiums.

More than one policy can earn a discount – Many insurance companies give a discount for people who carry more than one policy. It’s known as a multi-policy discount. The discount can add up to ten or even fifteen percent. Even if you already get this discount, drivers will still want to shop around to guarantee you are still saving the most.

Accidents can increase premiums – Having a clean driving record has a big impact on rates. Just one driving citation may increase your cost to the point where it’s not affordable. Attentive drivers have lower premiums than people who have multiple driving citations. Drivers who have received flagrant violations such as reckless driving, hit and run or driving under the influence may need to submit a SR-22 form with their state DMV in order to drive a vehicle legally.

The chart below illustrates how speeding tickets and at-fault fender-benders raise Acura ZDX insurance premiums for each different age group. The prices are based on a married female driver, comprehensive and collision coverage, $250 deductibles, and no policy discounts are applied.

Employer impacts rates – Do you work in a high-stress field? Occupations such as military personnel, social workers, and dentists tend to pay higher rates than average because of intense work-related stress and lots of time spent at work. On the flip side, jobs like professors, athletes and homemakers get better rates.

Rental and towing coverage may not be needed – There are many additional coverages that may not really be needed on your car insurance policy. Things like rental car coverage, accident forgiveness, and Farm Bureau memberships are some examples. These coverages may sound good at first, but now you might not need them so remove them and pocket the money.

Never let your policy lapse – Driving without insurance coverage in place is a big no-no and you will pay a penalty because you let your coverage have a gap. Not only will you pay higher rates, not being able to provide proof of insurance could earn you a fine, jail time, or a revoked license.

Don’t cut corners with liability coverage – Your policy’s liability coverage kicks in if ever you are responsible for physical damage or personal injury to other. This coverage provides for a legal defense to attempt to prove you were not liable. Liability is cheap compared to physical damage coverage, so do not skimp.

The fastest way that we advise to compare policy rates for Acura ZDX insurance in Scottsdale is to take advantage of the fact almost all companies will pay a fee to provide you with free rate quotes. The only thing you need to do is take a few minutes to give details such as whether the vehicles are used for commuting, daily mileage, whether you have decent credit, and your job. Those rating factors is automatically sent to multiple companies and you will get price comparisons within a short period of time.

If you would like to start a quote now, click here then complete the form.

The following companies have been selected to offer free quotes in Scottsdale, AZ. To find the cheapest car insurance in Arizona, it’s a good idea that you compare several of them in order to get a fair rate comparison.

Rates and other information

The price information displayed next showcases different insurance policy prices for Acura ZDX models. Learning how auto insurance prices are established is important for making smart choices when selecting a policy.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $290 | $526 | $404 | $24 | $122 | $1,366 | $114 |

| ZDX AWD | $290 | $526 | $404 | $24 | $122 | $1,366 | $114 |

| ZDX Advance Package AWD | $290 | $594 | $404 | $24 | $122 | $1,434 | $120 |

| Get Your Own Custom Quote Go | |||||||

Data based on single female driver age 30, no speeding tickets, no at-fault accidents, $500 deductibles, and Arizona minimum liability limits. Discounts applied include multi-policy, claim-free, multi-vehicle, safe-driver, and homeowner. Premium amounts do not factor in garaging location in Scottsdale which can lower or raise rates considerably.

Physical damage deductibles: Should you raise them?

One of the most common car insurance questions is where should you set your physical damage deductibles. The data tables below help summarize the rate difference when you buy lower versus higher physical damage deductibles. The first data set uses a $250 deductible for physical damage and the second rate chart uses a $500 deductible.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $322 | $530 | $300 | $18 | $90 | $1,285 | $107 |

| ZDX AWD | $322 | $530 | $300 | $18 | $90 | $1,285 | $107 |

| ZDX Advance Package AWD | $322 | $600 | $300 | $18 | $90 | $1,355 | $113 |

| Get Your Own Custom Quote Go | |||||||

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $262 | $428 | $300 | $18 | $90 | $1,098 | $92 |

| ZDX AWD | $262 | $428 | $300 | $18 | $90 | $1,098 | $92 |

| ZDX Advance Package AWD | $262 | $484 | $300 | $18 | $90 | $1,154 | $96 |

| Get Your Own Custom Quote Go | |||||||

Data assumes married male driver age 30, no speeding tickets, no at-fault accidents, and Arizona minimum liability limits. Discounts applied include homeowner, claim-free, multi-vehicle, multi-policy, and safe-driver. Rates do not factor in vehicle location which can affect insurance rates significantly.

Using the data above, we can ascertain that using a $250 deductible costs about $16 more each month or $192 annually than selecting the higher $500 deductible. Due to the fact that you would have to pay $250 more if you turn in a claim with a $500 deductible as compared to a $250 deductible, if you average more than 16 months between claim filings, you would more than likely save some money by selecting a higher deductible.

The information below highlights how deductible choice and can increase or decrease Acura ZDX annual premium costs for different ages of insureds. The rate quotes are based on a married female driver, full physical damage coverage, and no discounts are applied.

Should you buy full coverage?

The diagram below shows the difference between Acura ZDX premium costs when comparing full coverage to state minimum liability only. Data assumes a clean driving record, no claims, $1,000 deductibles, drivers are not married, and no discounts are factored in.

When to drop comprehensive and collision

There is no definitive guideline of when to eliminate physical damage insurance, but there is a broad guideline. If the yearly cost of comp and collision coverage is about 10% or more of the settlement you would receive from your company, then you may need to consider dropping full coverage.

For example, let’s say your Acura ZDX settlement value is $8,000 and you have $1,000 full coverage deductibles. If your vehicle is totaled in an accident, the most you would get paid by your company is $7,000 after paying your deductible. If premiums are more than $700 annually to have full coverage, then it may be the right time to buy liability only.

There are a few cases where dropping physical damage coverage is not a good plan. If you still have a lienholder on your title, you have to carry full coverage to satisfy the loan requirements. Also, if your finances do not allow you to purchase a different vehicle if your current one is damaged, you should not drop full coverage.

Three reasons to not skimp on car insurance

Despite the high cost, insuring your vehicle is required in Arizona but it also protects you in many ways.

- Most states have mandatory insurance requirements which means you are required to carry a specific minimum amount of liability insurance coverage in order to be legal. In Arizona these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If your Acura has a loan, it’s guaranteed your bank will force you to have insurance to guarantee loan repayment. If the policy lapses, the bank may insure your Acura for a much higher rate and force you to pay much more than you were paying before.

- Car insurance preserves not only your car but also your assets. Insurance will also pay for all forms of medical expenses for yourself as well as anyone injured by you. Liability insurance, one of your policy coverages, will also pay to defend you if someone files suit against you as the result of an accident. If mother nature or an accident damages your car, collision and comprehensive coverages will pay to restore your vehicle to like-new condition.

The benefits of having insurance are definitely more than the cost, especially with large liability claims. The average driver in America overpays more than $865 each year so you should quote and compare rates at least once a year to ensure rates are competitive.

Get cheaper rates with discounts

Insuring your fleet can be pricey, but there’s a good chance there are discounts that you may not even know about. Many discounts should be triggered at the time of purchase, but a few need to be inquired about before you will receive the discount. If you don’t get every credit possible, you are not getting the best rate possible.

- Data Collection Discounts – People who choose to allow companies to analyze driving manner by installing a telematics device like Drivewise from Allstate or In-Drive from State Farm might get better premium rates if they have good driving habits.

- Discounts for Safe Drivers – Insureds without accidents may save up to 50% more than drivers with accident claims.

- Senior Citizen Discount – Older drivers may qualify for a slight reduction on a Scottsdale auto insurance quote.

- Bundle and Save – If you can combine your auto and home policy and insure them both with the same insurance company you may save over 10 percent off each policy depending on the company.

- New Vehicle Savings – Insuring a new ZDX is cheaper because newer vehicles are generally safer.

- Distant College Student Discount – Youth drivers living away from Scottsdale attending college without a vehicle on campus can be insured at a reduced rate.

- No Accidents – Good drivers with no accidents can earn big discounts as compared to bad drivers.

- ABS Brakes – Anti-lock brake equipped vehicles are much safer to drive and will save you 10% or more on ZDX insurance in Scottsdale.

Remember that some of the credits will not apply to the whole policy. Some only apply to specific coverage prices like medical payments or collision. Despite the fact that it seems like you would end up receiving a 100% discount, that’s just not realistic.

The illustration below compares Acura ZDX auto insurance rates with and without discounts applied to the premium. The prices are based on a female driver, no tickets, no at-fault accidents, Arizona state minimum liability limits, comprehensive and collision coverage, and $500 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-policy, homeowner, safe-driver, claim-free, multi-car, and marriage discounts applied.

Some of the larger companies that may offer quotes with some of the discounts shown above are:

- GEICO

- Mercury Insurance

- Farmers Insurance

- Auto-Owners Insurance

- Liberty Mutual

- SAFECO

- Progressive

- USAA

If you are trying to find low cost Scottsdale auto insurance quotes, ask each company the best way to save money. Some of the discounts discussed earlier might not apply in Scottsdale. If you would like to choose from a list of providers that offer the discounts shown above in Scottsdale, click here.

When to talk to a local insurance agent

Some people just prefer to talk to a local agent and that is OK! Professional agents will help you protect your assets and will help you if you have claims. One of the great benefits of comparing rate quotes online is that you can obtain cheap rate quotes and still have an agent to talk to.

After filling out this quick form, your insurance data is transmitted to companies in Scottsdale that can give you free Scottsdale auto insurance quotes for your coverage. There is no reason to find an agent on your own since rate quotes are delivered immediately to your email address. If for some reason you want to get a price quote from a specific insurance company, you would need to visit that company’s website and complete a quote there.

Picking a provider needs to be determined by more than just a cheap quote. The following questions are important to ask.

- Do they see any coverage gaps in your plan?

- Will you work with the agent or an assistant?

- How often do they review coverages?

- Is the quote a firm price?

- Do they prorate repair cost based on vehicle mileage?

- Is coverage determined by price?

Scottsdale car insurance agents are either independent or exclusive

When searching for a reputable insurance agent or broker, it’s helpful to know the types of insurance agents and how they can quote your rates. Insurance agencies in Scottsdale can be categorized as either exclusive or independent agents depending on their company appointments. Both types of agents can properly insure your vehicles, but we need to point out the difference in the companies they write for since it could factor into which agent you choose.

Exclusive Auto Insurance Agencies

Agents in the exclusive channel are contracted to one company and examples are Allstate, State Farm and Farmers Insurance. They generally cannot provide other company’s prices so it’s a take it or leave it situation. Exclusive agents receive extensive training on their company’s products and that allows them to sell at a higher price point.

Listed below are Scottsdale exclusive agencies that can give you comparison quotes.

Steve Fair – State Farm Insurance Agent

33717 N Scottsdale Rd #101 – Scottsdale, AZ 85266 – (480) 563-2710 – View Map

American Family Insurance – Denis Zdrale

7001 N Scottsdale Rd #1045 – Paradise Valley, AZ 85253 – (480) 951-0115 – View Map

Roz Bankston – State Farm Insurance Agent

6900 E Camelback Rd #820 – Scottsdale, AZ 85251 – (480) 897-6500 – View Map

Independent Agencies or Brokers

Agents that choose to be independent do not have single company limitations so as a result can place your coverage through many companies and help determine which has the cheapest rates. If your premiums go up, they simply move your policy to a different company and that require little work on your part.

When searching for an agent, you will want to compare prices from at least one independent agent so that you have a good selection of quotes to compare.

Shown below is a list of independent agencies in Scottsdale who can help you get price quote information.

Greene Insurance Group

17470 N Pacesetter Way – Scottsdale, AZ 85255 – (480) 657-2800 – View Map

Diemer Insurance Agency Inc

16050 N 76th St – Scottsdale, AZ 85260 – (480) 264-2854 – View Map

Crest Insurance Group, LLC

7900 E Thompson Peak Pkwy # 10 – Scottsdale, AZ 85255 – (480) 860-6453 – View Map

Do I just need basic coverages?

When quoting and comparing coverage, there really is no one size fits all plan. Each situation is unique so this has to be addressed.

Here are some questions about coverages that can aid in determining whether you would benefit from an agent’s advice.

- I don’t drive much so do I pay less?

- Does my insurance cover a custom paint job?

- Can I drive in Mexico and have coverage?

- Do I need medical payments coverage since I have good health insurance?

- Does my medical payments coverage pay my health insurance deductible?

- Where can I get insurance after a DUI in Arizona?

- Are rock chip repairs covered?

- Do I have coverage when using my vehicle for my home business?

- Is coverage enough to protect my assets?

If it’s difficult to answer those questions but you know they apply to you then you might want to talk to a licensed insurance agent. To find an agent in your area, take a second and complete this form or you can go here for a list of companies in your area. It’s fast, doesn’t cost anything and can help protect your family.

Find cheaper rates by being thorough

Cheaper insurance in Scottsdale can be found on the web as well as from independent agents in Scottsdale, so you need to quote Scottsdale auto insurance with both in order to have the best price selection to choose from. Some insurance companies may not have the ability to get quotes online and most of the time these smaller companies provide coverage only through local independent agents.

As you go through the steps to switch your coverage, don’t be tempted to sacrifice coverage to reduce premiums. There are a lot of situations where an insured cut full coverage to discover at claim time that saving that couple of dollars actually costed them tens of thousands. The goal is to buy enough coverage at an affordable rate, but do not skimp to save money.

We just showed you many ways to reduce Acura ZDX insurance rates online in Scottsdale. The key concept to understand is the more rate comparisons you have, the more likely it is that you will get a better rate. You may even discover the most savings is with the smaller companies. Regional companies can often provide lower car insurance rates in certain areas than their larger competitors like GEICO and State Farm.

More information can be read at the links below

- How to shop for a safer car (Insurance Institute for Highway Safety)

- Who Has Cheap Auto Insurance Rates for a Nissan Altima in Scottsdale? (FAQ)

- Who Has the Cheapest Scottsdale Car Insurance Quotes for a Toyota Highlander? (FAQ)

- What Insurance is Cheapest for Lyft Drivers in Scottsdale? (FAQ)

- Booster Seat Ratings (iihs.org)

- Liability Insurance Coverage (Nationwide)

- Protect Yourself Against Auto Theft (Insurance Information Institute)

- Parking Tips to Reduce Door Dings (State Farm)