It takes a little time, but the best way to find affordable Lexus RX 400h insurance in Scottsdale is to do a yearly price comparison from different companies in Arizona. Prices can be compared by completing these steps.

First, try to learn a little about what coverages are included in your policy and the steps you can take to keep rates in check. Many factors that cause high rates such as at-fault accidents, careless driving, and bad credit can be amended by making lifestyle changes or driving safer. This article provides information to keep prices down and get additional discounts.

Second, get rate quotes from independent agents, exclusive agents, and direct companies. Exclusive agents and direct companies can provide rates from one company like GEICO or State Farm, while agents who are independent can provide rate quotes from many different companies.

Third, compare the new rate quotes to your existing coverage and see if there is a cheaper rate in Scottsdale. If you find a lower rate quote and switch companies, make sure coverage does not lapse between policies.

Fourth, tell your current agent or company to cancel your existing policy and submit a completed policy application and payment to the new insurer. As soon as you have the new policy, place the new certificate verifying coverage in an easily accessible location.

One piece of advice is to make sure you enter the same amount of coverage on each quote request and and to get price estimates from as many companies as feasibly possible. Doing this enables an accurate price comparison and and a good selection of different prices.

It’s a fact that car insurance companies want to keep you from shopping around. People who get price comparisons are inclined to switch car insurance companies because of the high probability of finding lower prices. Surprisingly, a recent survey revealed that drivers who shopped around every year saved an average of $72 a month compared to policyholders who never shopped for cheaper rates.

It’s a fact that car insurance companies want to keep you from shopping around. People who get price comparisons are inclined to switch car insurance companies because of the high probability of finding lower prices. Surprisingly, a recent survey revealed that drivers who shopped around every year saved an average of $72 a month compared to policyholders who never shopped for cheaper rates.

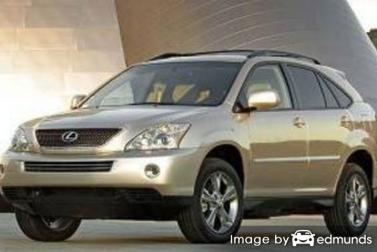

If finding the lowest price on auto insurance in Scottsdale is the reason you’re here, then having some knowledge of the best ways to find and compare insurance premiums can save time, money, and frustration.

Finding the lowest-priced coverage in Scottsdale can be fairly easy. If you are insured now or just want cheaper rates, you can use this information to get lower rates and possibly find even better coverage. Drivers just need to learn the most time-saving way to compare rate quotes online.

Companies offer many discounts on Lexus RX 400h insurance in Scottsdale

Car insurance is not cheap, but there are discounts available that could drop your premiums quite a bit. A few discounts will automatically apply when you get a quote, but occasionally some discounts must be requested specifically before you will receive the discount.

- Buy New and Save – Adding a new car to your policy can get you a discount compared to insuring an older model.

- Discount for Low Mileage – Driving less may allow you to get lower rates on the low mileage vehicles.

- Claim Free – Drivers who don’t have accidents pay less as opposed to policyholders that have many claims.

- Student Driver Training – Make teen driver coverage more affordable by requiring them to enroll and complete driver’s education in school or through a local driver safety program.

- Employee of Federal Government – Active or former government employment can earn a discount up to 10% with certain companies.

As a disclaimer on discounts, most discounts do not apply to the overall cost of the policy. A few only apply to individual premiums such as liability and collision coverage. If you do the math and it seems like you could get a free insurance policy, you aren’t that lucky. But any discount will lower the cost of your policy.

Insurance companies that may offer quotes with most of these discounts include:

Before purchasing a policy, check with each insurance company what discounts are available to you. Some of the discounts discussed earlier might not be offered in Scottsdale. To find providers with discount rates in Arizona, click this link.

Lexus RX 400h insurance quotes comparison

The following companies have been selected to offer price comparisons in Arizona. To buy cheap auto insurance in Scottsdale, AZ, it’s highly recommended you visit several of them in order to get a fair rate comparison.

Can’t I compare rate quotes from local Scottsdale insurance agents?

Many people would prefer to talk to a local agent and that is recommended in a lot of cases Agents are trained risk managers and will help you if you have claims. One of the best bonuses of getting online price quotes is the fact that you can find the best rates but also keep your business local. Supporting neighborhood insurance agencies is especially important in Scottsdale.

After completing this simple form, your insurance coverage information is submitted to local insurance agents in Scottsdale who will return price quotes to get your business. You never need to visit any agencies since rate quotes are delivered straight to your inbox. If you want to quote rates from one company in particular, don’t hesitate to jump over to their website and submit a quote form there.

If you want to buy auto insurance from a local Scottsdale insurance agency, it can be helpful to understand the different agency structures and how they work. Agents are considered either independent or exclusive depending on the company they work for. Either type can write policy coverage, but it’s worth learning the difference between them because it can impact buying decisions.

Independent Auto Insurance Agencies or Brokers

Independent agencies often have many company appointments and that is an advantage because they can write policies with any number of different companies and possibly get better coverage at lower prices. If prices rise, your policy is moved internally and you stay with the same agent.

When comparing rate quotes, you will definitely want to contact independent agents for the best price selection. Most can insure with companies you’ve never heard of who may have lower rates.

Listed below is a small list of independent insurance agencies in Scottsdale that may be able to give free rate quotes.

- Jeremy Mueller Insurance Inc

8700 E Pinnacle Peak Rd # 110 – Scottsdale, AZ 85255 – (480) 515-5223 – View Map - Desert Mountain Insurance Services – Medical Malpractice

2918 N 67th Pl – Scottsdale, AZ 85251 – (480) 348-2200 – View Map - Good’s Insurance Agency, Inc. – South West

33725 N Scottsdale Rd #125h – Scottsdale, AZ 85266 – (877) 208-6690 – View Map

Exclusive Agents

Agents that choose to be exclusive can usually just insure with one company such as Allstate, AAA, Farmers Insurance, and State Farm. Exclusive agents are unable to shop your coverage around so they have to upsell other benefits. Exclusive agencies are usually quite knowledgeable on their products and sales techniques which helps offset the inability to provide other markets. Consumers sometimes purchase coverage from exclusives mostly because of the brand name and strong financial ratings.

Shown below are exclusive insurance agents in Scottsdale willing to provide rate quotes.

- American Family Insurance – Winston Vineyard Agency LLC

9280 E Raintree Dr Ste 103 – Scottsdale, AZ 85260 – (480) 951-8890 – View Map - Athena Olson – State Farm Insurance Agent

8170 N 86th Pl #105 – Scottsdale, AZ 85258 – (480) 398-1266 – View Map - American Family Insurance – J M Chapman Agency Inc

7055 E Thomas Rd – Scottsdale, AZ 85251 – (480) 945-7122 – View Map

Picking a car insurance agent is decision based upon more than just the premium amount. Agents should be asked these questions:

- Is the coverage adequate for your vehicle?

- Will they make sure you get an adequate claim settlement?

- Is the quote a firm price?

- Do they have designations such as AIC, CPCU, or CIC?

- How does the company pay claims for a total loss?

- Is coverage determined by price?

Best auto insurance in Arizona

Picking the highest-rated company can be a challenge considering how many companies there are to choose from in Scottsdale. The rank data in the lists below could help you choose which auto insurers to look at comparing prices from.

Top 10 Scottsdale Car Insurance Companies by A.M. Best Rank

- USAA – A++

- Travelers – A++

- State Farm – A++

- GEICO – A++

- Esurance – A+

- Nationwide – A+

- Allstate – A+

- Mercury Insurance – A+

- Progressive – A+

- Titan Insurance – A+

Top 10 Scottsdale Car Insurance Companies Ranked by Value

- USAA

- American Family

- The Hartford

- Titan Insurance

- The General

- Mercury Insurance

- AAA Insurance

- State Farm

- Nationwide

- Safeco

One last thing about your coverage

In this article, we presented many ideas to reduce Lexus RX 400h insurance auto insurance rates online in Scottsdale. The key concept to understand is the more price quotes you have, the better chance you’ll have of finding affordable Scottsdale car insurance quotes. You may even discover the lowest auto insurance rates are with a smaller regional carrier.

A few companies don’t offer rate quotes online and many times these small, regional companies sell through independent agencies. The cheapest Lexus RX 400h insurance in Scottsdale can be purchased both online and with local Scottsdale insurance agents, so you should be comparing quotes from both so you have a total pricing picture.

When searching for affordable Lexus RX 400h insurance quotes, it’s a bad idea to buy less coverage just to save a little money. In many cases, an insured cut uninsured motorist or liability limits only to discover later that the savings was not a smart move. Your focus should be to get the best coverage possible for the lowest cost, but do not skimp to save money.

To learn more, feel free to visit the resources below:

- Vehicle Insurance in the U.S. (Wikipedia)

- How Much are Auto Insurance Rates for a Nissan Rogue in Scottsdale? (FAQ)

- What Insurance is Cheapest for a Ford Focus in Scottsdale? (FAQ)

- Automakers compete to add autobraking (Insurance Institute for Highway Safety)

- Auto Crash Statistics (Insurance Information Institute)