Scraping up a payment for overpriced Nissan 350Z insurance in Scottsdale can empty your accounts and possibly require you to analyze your spending habits. Doing a price comparison can be a smart way to make ends meet.

Scraping up a payment for overpriced Nissan 350Z insurance in Scottsdale can empty your accounts and possibly require you to analyze your spending habits. Doing a price comparison can be a smart way to make ends meet.

We don’t have to tell you that car insurance companies want to keep you from comparing prices. Consumers who shop around for cheaper rates are likely to buy a new policy because there are good odds of getting low-cost coverage. A survey found that drivers who compared rates once a year saved over $3,400 over four years as compared to drivers who never compared prices.

If finding the cheapest price on insurance in Scottsdale is why you’re reading this, then having a good understanding the best way to shop and compare coverage rates can help you succeed in finding affordable rates. Consumers have many insurers to pick from, and though it is a good thing to have multiple companies, it makes it harder to find the lowest rates for Nissan 350Z insurance in Scottsdale.

Informed Drivers Can Save Money

Many factors are considered when pricing auto insurance. Some are obvious like a motor vehicle report, but some are less apparent like your continuous coverage or how financially stable you are. Part of the car insurance buying process is learning a few of the rating criteria that aid in calculating your car insurance rates. If you understand what influences your rates, this allows you to make educated decisions that could help you find big savings.

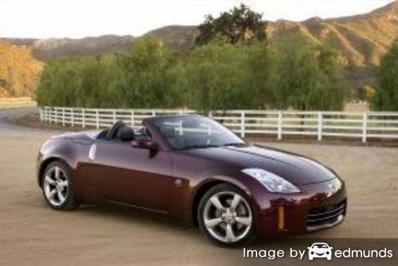

- Performance influences costs – The performance of the car you need insurance for makes a significant difference in your auto insurance rates. Low performance passenger cars generally receive the lowest base rates, but many other things help determine your insurance rates.

- Bump up physical damage deductibles to lower rates – Your deductibles tell how much you are willing to pay out-of-pocket in the event of a claim. Coverage for physical damage, otherwise known as comp (or other than collision) and collision, covers damage that occurs to your car. Examples of some claims that would be covered are collision with another vehicle, damage from fire, and damage from wind. The more money the insured has to pay upfront, the better rate you will receive.

- Get hitched and pay less – Being married may earn you lower rates compared to being single. Having a significant other generally demonstrates drivers are more responsible it has been statistically shown that married couples file fewer claims.

- Miles driven impacts premiums – The more you drive your Nissan in a year the more it will cost to insure it. Many insurance companies price each vehicle’s coverage based on how the vehicle is used. Vehicles left parked in the garage get more affordable rates than those used for commuting. It’s a good idea to make sure your car insurance policy shows the correct usage for each vehicle, because improper ratings can cost you money. Having an incorrect usage rating on your 350Z can cost quite a bit.

Insurance discounts are available for cheaper rates

Insurance is not cheap nor is it fun to buy but discounts can save money and there are some available that can drop the cost substantially. A few discounts will automatically apply when you get a quote, but a few must be manually applied in order for you to get them.

- Discount for Good Grades – Performing well in school may save you up to 25%. The good student discount can last up to age 25.

- Anti-theft System – Cars equipped with tracking devices and advanced anti-theft systems help deter theft and therefore earn up to a 10% discount.

- E-sign Discounts – Certain companies give back up to $50 shop Scottsdale auto insurance digitally online.

- No Claim Discounts – Insureds who avoid accidents and claims can save substantially in comparison with policyholders that have many claims.

- ABS Brakes – Anti-lock brake equipped vehicles are safer to drive so companies give up to a 10% discount.

- Discount for Passive Restraints – Options like air bags or automatic seat belts may qualify for discounts up to 30%.

- Driver’s Education for Students – It’s a good idea to have your young drivers successfully take a driver’s education course as it can save substantially.

As a sidenote, most of the big mark downs will not be given to the entire policy premium. Some only apply to the cost of specific coverages such as liability and collision coverage. So even though they make it sound like all the discounts add up to a free policy, you’re out of luck.

Popular insurance companies and a partial list of their discounts can be read below.

- State Farm policyholders can earn discounts including accident-free, good student, anti-theft, multiple policy, safe vehicle, defensive driving training, and student away at school.

- Farmers Insurance may have discounts that include mature driver, homeowner, youthful driver, distant student, switch companies, business and professional, and early shopping.

- Progressive has savings for continuous coverage, online quote discount, online signing, multi-policy, homeowner, good student, and multi-vehicle.

- GEICO may include discounts for good student, multi-vehicle, seat belt use, defensive driver, and air bags.

- Auto-Owners Insurance offers premium reductions for mature driver, paid in full, anti-theft, safe vehicle, and group or association.

- The Hartford includes discounts for good student, anti-theft, air bag, vehicle fuel type, driver training, and defensive driver.

- Farm Bureau has discounts for good student, multi-policy, multi-vehicle, renewal discount, 55 and retired, and driver training.

- USAA may offer discounts for defensive driver, safe driver, loyalty savings, driver training, good student, multi-vehicle, and military installation.

Check with each company or agent which discounts you qualify for. Some of the earlier mentioned discounts may not be available in Scottsdale.

Best auto insurance in Arizona

Ending up with the best auto insurance provider is difficult considering how many companies there are to choose from in Scottsdale. The company information shown below can help you choose which coverage providers to look at when shopping around.

Top 10 Scottsdale Car Insurance Companies Overall

- USAA

- American Family

- State Farm

- The Hartford

- AAA Insurance

- GEICO

- The General

- Titan Insurance

- Progressive

- Mercury Insurance

Cheaper insurance premiums are possible

A few companies do not provide price quotes online and these small, regional companies provide coverage only through local independent agencies. Discount Nissan 350Z insurance is possible online and also from your neighborhood Scottsdale agents, and you should be comparing both to have the best rate selection.

You just read some good ideas how to compare Nissan 350Z insurance prices in Scottsdale. The key thing to remember is the more price quotes you have, the more likely it is that you will get a better rate. You may even be surprised to find that the lowest prices come from a lesser-known regional company. Some small companies may cover specific market segments cheaper as compared to the big name companies such as Allstate and Progressive.

How to find affordable Nissan 350Z insurance in Scottsdale

Really, the only way to quote cheaper Nissan 350Z insurance is to make a habit of comparing prices annually from insurers in Scottsdale. You can compare prices by following these guidelines.

- Learn about how auto insurance works and the changes you can make to prevent expensive coverage. Many policy risk factors that result in higher prices like at-fault accidents and a bad credit score can be controlled by paying attention to minor details.

- Compare prices from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only provide price estimates from one company like GEICO or Farmers Insurance, while independent agencies can quote prices from multiple sources. View prices

- Compare the new rate quotes to the premium of your current policy and determine if there is any savings. If you find a better price and change companies, ensure coverage does not lapse between policies.

One important bit of advice is to make sure you’re comparing the same liability limits and deductibles on each quote and and to analyze as many car insurance companies as possible. Doing this guarantees a fair rate comparison and a complete rate analysis.

More detailed insurance information is available at these sites:

- Older Drivers FAQ (iihs.org)

- Who Has Affordable Car Insurance for Drivers with a Bad Driving Record in Scottsdale? (FAQ)

- What Car Insurance is Cheapest After a Speeding Ticket in Scottsdale? (FAQ)

- What Insurance is Cheapest for Lyft Drivers in Scottsdale? (FAQ)

- Who Has the Cheapest Car Insurance for Homeowners in Scottsdale? (FAQ)

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- Teen Driver Licensing Information (iihs.org)

- New vehicle ratings focus on headlights (Insurance Institute for Highway Safety)

- Preventing Carjacking and Theft (Insurance Information Institute)