We don’t have to tell you that car insurance companies want to prevent you from shopping around. People who compare rates annually will most likely switch companies because there is a great chance of finding a lower-priced company. A study discovered that drivers who routinely shopped around saved over $865 annually as compared to drivers who never shopped around for lower prices.

If finding low prices for insurance is your objective, then having an understanding of how to quote prices and compare coverage rates can make it easier for you to save money.

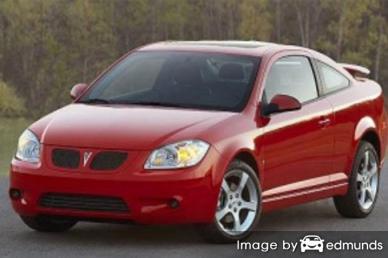

The most effective way to get more affordable Pontiac G5 insurance is to start comparing prices yearly from companies that insure vehicles in Scottsdale.

The most effective way to get more affordable Pontiac G5 insurance is to start comparing prices yearly from companies that insure vehicles in Scottsdale.

- Step 1: Try to learn a little about what coverages are included in your policy and the steps you can take to lower rates. Many things that drive up the price like accidents, traffic violations, and a bad credit score can be improved by paying attention to minor details. Keep reading for more ideas to prevent high prices and find more discounts that you may not know about.

- Step 2: Compare rates from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only provide price estimates from a single company like Progressive or State Farm, while agents who are independent can give you price quotes from many different companies.

- Step 3: Compare the quotes to your existing coverage and see if there is a cheaper rate in Scottsdale. If you find a lower rate and change companies, make sure there is no lapse in coverage.

A key point to remember is to try to use the same level of coverage on each quote and and to get rates from every company you can. Doing this helps ensure the most accurate price comparison and a good representation of prices.

Do you qualify for these six discounts?

Some providers don’t always list all discounts in a way that’s easy to find, so the list below details a few of the more common and also the lesser-known credits available to lower your premiums when you buy Scottsdale car insurance online.

- Early Payment Discounts – By paying your entire bill at once as opposed to paying monthly you could save up to 5%.

- Online Discount – Many car insurance companies give back up to $50 for signing up digitally online.

- Student in College – College-age children who live away from home at college and leave their car at home can be insured at a reduced rate.

- Driver’s Ed – Reduce the cost of insurance for teen drivers by having them successfully take a driver’s education course as it will make them better drivers and lower rates.

- Buy New and Save – Adding a new car to your policy is cheaper because newer models are generally safer.

- Driver Training Discounts – Successfully completing a course teaching defensive driver skills could save 5% or more and easily pay for the cost of the class.

As is typical with insurance, most credits do not apply to the overall cost of the policy. Most only reduce individual premiums such as physical damage coverage or medical payments. So even though you would think you can get free auto insurance, it just doesn’t work that way.

Larger car insurance companies and the discounts they provide are detailed below.

- State Farm has discounts for safe vehicle, multiple autos, good student, accident-free, and good driver.

- GEICO includes discounts for seat belt use, multi-vehicle, federal employee, driver training, five-year accident-free, and emergency military deployment.

- Liberty Mutual may offer discounts for newly married, hybrid vehicle, multi-car, multi-policy, new move discount, and new vehicle discount.

- The Hartford discounts include good student, air bag, bundle, defensive driver, vehicle fuel type, anti-theft, and driver training.

- MetLife policyholders can earn discounts including good driver, good student, accident-free, claim-free, defensive driver, multi-policy

- Progressive may include discounts for good student, multi-vehicle, online signing, multi-policy, continuous coverage, homeowner, and online quote discount.

If you are trying to find cheaper Scottsdale car insurance quotes, ask all companies you are considering to apply every possible discount. Savings might not be offered in every state. To choose companies with significant discounts in Scottsdale, click this link.

The companies in the list below can provide price quotes in Arizona. To find cheap auto insurance in Scottsdale, it’s highly recommended you click on several of them in order to find the cheapest rates.

Local neighborhood insurance agents

Many people prefer to talk to an insurance agent and doing so can bring peace of mind Professional agents are very good at helping people manage risk and help submit paperwork. A nice benefit of getting free rate quotes online is the fact that you can find cheap auto insurance rates and still buy from a local agent.

To find an agent, once you fill out this short form, your insurance data is instantly submitted to companies in Scottsdale who can give free rate quotes for your business. You won’t need to do any legwork because prices are sent directly to your email. If you wish to get a price quote from a specific auto insurance provider, don’t hesitate to go to their quote page and submit a quote form there.

To find an agent, once you fill out this short form, your insurance data is instantly submitted to companies in Scottsdale who can give free rate quotes for your business. You won’t need to do any legwork because prices are sent directly to your email. If you wish to get a price quote from a specific auto insurance provider, don’t hesitate to go to their quote page and submit a quote form there.

Choosing an insurance company should include more criteria than just the premium amount. A good agent in Scottsdale will have answers to these questions.

- Are they properly licensed to sell insurance in Arizona?

- Do they reduce claim amounts on high mileage vehicles?

- Do they have adequate Errors and Omissions coverage? This protects you if they make a mistake.

- Does the agent have professional designations like CIC, CPCU or AIC?

- Is vehicle damage repaired with OEM or aftermarket parts?

- How many years of experience in personal auto insurance do they have?

The following are agents in Scottsdale willing to provide rate quotes for Pontiac G5 insurance in Scottsdale.

Brandon Mueller – State Farm Insurance Agent

6149 N Scottsdale Rd #106 – Scottsdale, AZ 85250 – (480) 991-0119 – View Map

American Family Insurance – J M Chapman Agency Inc

7055 E Thomas Rd – Scottsdale, AZ 85251 – (480) 945-7122 – View Map

Crest Insurance Group

Ste 375, 7272 E Indian School Rd – Scottsdale, AZ 85251 – (480) 839-2252 – View Map

Diemer Insurance Agency Inc

16050 N 76th St – Scottsdale, AZ 85260 – (480) 264-2854 – View Map

Protect more than your Pontiac vehicle

Despite the high cost, paying for insurance serves an important purpose.

- Just about all states have compulsory liability insurance requirements which means state laws require specific minimum amounts of liability protection in order to be legal. In Arizona these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you took out a loan on your G5, more than likely the lender will make it a condition of the loan that you have comprehensive coverage to ensure loan repayment if the vehicle is totaled. If the policy lapses, the lender will be forced to insure your Pontiac at an extremely high rate and require you to fork over a much higher amount than you were paying before.

- Insurance safeguards both your vehicle and your personal assets. It will also reimburse you for most medical and hospital costs incurred in an accident. Liability insurance, one of your policy coverages, also pays expenses related to your legal defense if someone files suit against you as the result of an accident. If mother nature or an accident damages your car, your policy will pay to restore your vehicle to like-new condition.

The benefits of insuring your car greatly outweigh the cost, especially for larger claims. But the average driver in Arizona is overpaying more than $850 per year so you should quote rates every year to make sure the price is not too high.

Auto insurance coverage options for a Pontiac G5

Understanding the coverages of a auto insurance policy aids in choosing appropriate coverage at the best deductibles and correct limits. Policy terminology can be impossible to understand and nobody wants to actually read their policy. Listed below are the usual coverages found on the average auto insurance policy.

Collision coverage protection

This covers damage to your G5 resulting from a collision with a stationary object or other vehicle. A deductible applies then your collision coverage will kick in.

Collision coverage pays for claims such as crashing into a building, sideswiping another vehicle, scraping a guard rail and crashing into a ditch. Paying for collision coverage can be pricey, so you might think about dropping it from vehicles that are 8 years or older. You can also choose a higher deductible on your G5 to save money on collision insurance.

Coverage for medical payments

Medical payments and Personal Injury Protection insurance kick in for expenses like dental work, ambulance fees, X-ray expenses, chiropractic care and hospital visits. They can be used to cover expenses not covered by your health insurance policy or if you are not covered by health insurance. Medical payments and PIP cover both the driver and occupants and will also cover being hit by a car walking across the street. Personal Injury Protection is not universally available and gives slightly broader coverage than med pay

Comprehensive coverages

This covers damage caused by mother nature, theft, vandalism and other events. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive can pay for things like damage from getting keyed, a broken windshield, fire damage and falling objects. The highest amount your auto insurance company will pay is the actual cash value, so if your deductible is as high as the vehicle’s value it’s not worth carrying full coverage.

Uninsured and underinsured coverage

Your UM/UIM coverage provides protection when the “other guys” either have no liability insurance or not enough. This coverage pays for injuries to you and your family and also any damage incurred to your Pontiac G5.

Since many Arizona drivers only purchase the least amount of liability that is required (15/30/10 in Arizona), it doesn’t take a major accident to exceed their coverage limits. That’s why carrying high Uninsured/Underinsured Motorist coverage is important protection for you and your family.

Auto liability

Liability coverage provides protection from damages or injuries you inflict on other’s property or people. Liability coverage has three limits: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. As an example, you may have values of 15/30/10 which means a limit of $15,000 per injured person, a total of $30,000 of bodily injury coverage per accident, and property damage coverage for $10,000.

Liability can pay for claims like legal defense fees, structural damage and loss of income. How much coverage you buy is a personal decision, but it’s cheap coverage so purchase higher limits if possible. Arizona state minimum liability requirements are 15/30/10 but it’s recommended drivers buy more coverage.

The next chart demonstrates why the minimum limit may not be high enough to adequately cover claims.

Don’t give up on cheap coverage

While you’re price shopping online, it’s a bad idea to buy less coverage just to save a little money. There have been many cases where someone dropped uninsured motorist or liability limits and discovered at claim time that the savings was not a smart move. Your aim should be to purchase a proper amount of coverage at the best price, but don’t skip important coverages to save money.

Affordable Pontiac G5 insurance in Scottsdale can be bought both online as well as from independent agents in Scottsdale, and you should compare price quotes from both to have the best chance of lowering rates. Some insurance companies do not provide the ability to get quotes online and many times these smaller providers only sell coverage through independent agents.

Helpful information

- Can I Drive Legally without Insurance? (Insurance Information Institute)

- How Much are Car Insurance Rates for Good Students in Scottsdale? (FAQ)

- What Insurance is Cheapest for State Employees in Scottsdale? (FAQ)

- What Auto Insurance is Cheapest for High Risk Drivers in Scottsdale? (FAQ)

- Who Has Affordable Auto Insurance Rates for 19 Year Olds in Scottsdale? (FAQ)

- Who Has Cheap Car Insurance Rates for Drivers with Bad Credit in Scottsdale? (FAQ)

- Anti-Lock Brake FAQ (iihs.org)

- What Determines the Price of My Auto Insurance Policy? (Insurance Information Institute)

- Choosing a Car for Your Teen (State Farm)